who claims child on taxes with 50/50 custody

How do taxes work with 5050 custody. Who Claims a Child on Taxes With 5050 Custody.

Who Claims A Child On Taxes In A 50 50 Custody Arrangement

In the case of a true 5050 arrangement the question of who gets a claim as custodial parent can become complicated and the answer may depend on your state or particular situation.

. Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim the child as a dependent The custodial parent is the parent who has physical custody of the child for the majority of the year. The custodial parent as defined by the IRS claims the child tax credit in a 5050 division. California law states that in split 5050 child custody agreements the parent with the higher income can claim the child as a dependent on taxes.

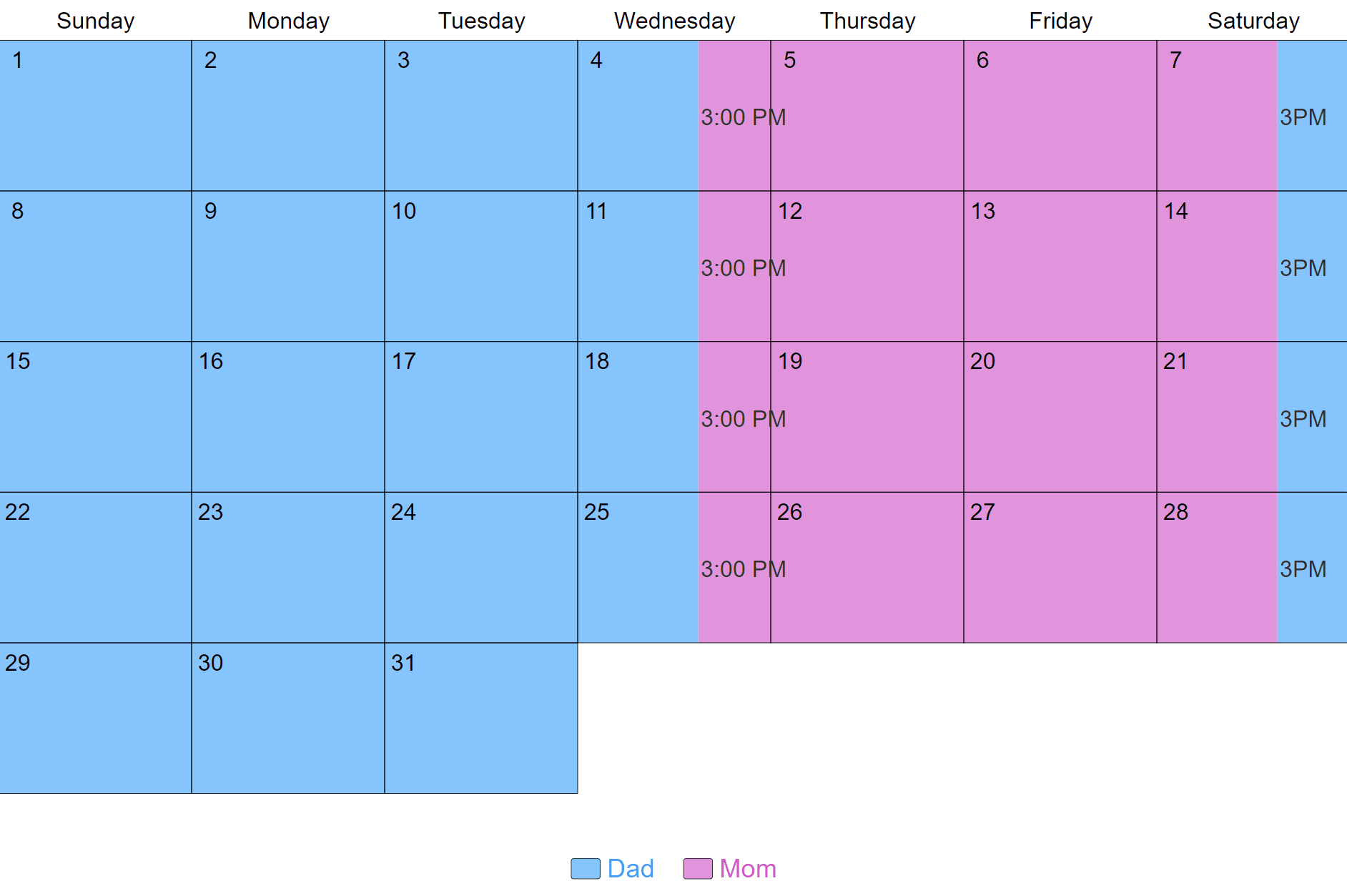

In some cases divorced or unmarried couples work out their own arrangements such as those with multiple children dividing their children as dependents or those with only one child or an odd number of children alternating which years. The exclusion from income for dependent care benefits. Both parents need to work together for joint custody with equally split time.

Below youll read about who claims a child on taxes with 5050 custody in California. Typically when parents share 5050 custody they alternate between odd and even. However most cases involve the custodial parent with joint physical custody claiming the deduction.

Who Gets the Tax Exemption in 5050 Custody Cases. Who claims child on taxes with 5050 custody. Assuming this is a 5050 custody arrangement between two parents with no third party involved and the parents dont file a joint tax return the priority would be.

When both parents agree on who claims child tax credit ahead of time this is less likely to be an issue. Many parents will alternate years to divide the tax credits equally. If either parent has signed a Release of Claim to Exemption for Child of Divorced or Separated Parents that individual will have essentially forfeited his or her right to claim the child as a dependent at tax time.

Ad Consult a Lawyer Specializing in Child Law. Free means free and IRS e-file is included. The other person cant take any of these benefits based on this qualifying child.

The court that handles the child custody case can usually include the tax exemption as part of the order giving a clear rule for who should use the exemption. The child tax credit or credit for other dependents. Get Help from an Expert Right Away.

Only one parent can claim a dependent child in a given tax year when parents are not married and filing taxes. Understanding whether youre eligible to claim your child could potentially save you. For Parents That Have a 5050 Custody Agreement.

Parents can also come to a mutual agreement regarding which of them will claim the child when filing for taxes. The Internal Revenue Service IRS typically allows the parent with whom the child lived most during the tax year to claim the child. A release has been signed.

Who Claims a Child on Taxes With 5050 Custody. Claim the Tax Refund You Deserve. Ad File to Get Your Child Tax Credits.

If youre going through a custody battle and youre wondering. According to the Colorado Courts the issue of child tax creditsexemptions comes down to the financial contributions of each parent to the children. Generally IRS rules state that a child is the qualifying child of the custodial parent and.

The earned income credit. The credit for child and dependent care expenses. Head of household filing status.

Both parents try to claim a child. Often in the case of 5050 custody and. Suppose that both parents divide time and caretaking of their minor children equally.

In California joint custody cases where parents share parenting time evenly it may not be clear who should benefit from the tax exemption. The answer lies in either your parenting time your income or your agreement with the other parent. Max refund is guaranteed and 100 accurate.

For a confidential consultation with an experienced child custody lawyer in Dallas contact Orsinger Nelson Downing Anderson LLP. For example a parent could conceivably have 0 overnights with the children and still have a right to claim the children on his or her taxes so long as they are significantly contributing financials. The parent with whom the child lived the longest - sometimes a nominal 5050 custody arrangement for educational purposes has the child staying with one parent marginally longer over the course of the year.

Our firm has more Super Lawyers than any other organization in the Lone Star State. If there is no true custodial parent the IRS allows the parent with the highest adjusted gross income to claim the child tax credit. But if the custody agreement mandates that its a 5050 split then the parent with the higher adjusted gross income gets to claim it.

But who gets to claim the kids if you have joint custody.

Who Claims The Child With 50 50 Parenting Time Equal Griffiths Law

How Do You Claim A Child On Taxes With 50 50 Custody

Are You Considering 50 50 Custody Schedule In St Louis Missouri Jr

Top Five Considerations For Child Custody Agreements In Louisiana

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

What Is Form 8332 Release Revocation Of Release Of Claim To Exemption For Child By Custodial Parent Turbotax Tax Tips Videos

50 50 Joint Custody Schedules Sterling Law Offices S C

4 3 Custody Visitation Schedules How Does It Work Pros Cons

50 50 Custody Are Courts Biased Against Men Graine Mediation

Florida 50 50 Parenting Plan 50 50 Custody And Child Support

Do I Have To Pay Child Support If I Share 50 50 Custody

New Child Tax Credit 2021 For Parents Who Share Custody

2 2 5 5 Visitation Schedule Examples How Does It Work

How Do You Claim A Child On Taxes With 50 50 Custody

How Do You Claim A Child On Taxes With 50 50 Custody

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

What Does A 50 50 Or Joint Custody Agreement Look Like

Child Support And 50 50 Custody In Illinois Updated March 2022

Who Claims Child On Taxes With 50 50 Custody Colorado Legal Group