new haven county property taxes

Convenience Fees for Online Payments. New Haven County Assessors Website httpswwwnewhavenctgovgovdeptsassessordefaulthtm Visit the New Haven County Assessors website for contact information office hours tax payments and bills parcel and GIS maps assessments and other property records.

Timeline For Property Taxes Carver County Mn

Visit Our Website Today To Get The Answers You Need.

. Parks Public Works Find information on local parks facilities recycling and street maintenance. Revenue Bill Search Pay - City Of New Haven. However the Polk County Property Appraiser mapping.

The median property tax also known as real estate tax in New Haven County is 462100 per year based on a median home value of 27330000 and a median effective property tax rate of 169 of property value. Fire Find best practices on keeping your home safe. City of New Haven per the FY 2022-2023 Mayors Proposed Budget Please note that this calculator returns an approximate value and does NOT account for personal exceptions Elderly Disabled Veterans.

Ad Make The Best Decision On Your First Home By Checking Tax Records Online. Effective July 1 2019 we are offering current year property tax payment by phone and through the internet. To pay by phone dial 1-833-440-3765.

Youth Recreation Register for sports camps and other activities. The median property tax in New Haven County Connecticut is 4621 per year for a home worth the median value of 273300. Ad See Anyones Public Records All Counties.

203 720 7016 Phone 203 720 7207 Fax The New Haven County Tax Assessors Office is located in Naugatuck Connecticut. Account info last updated on Aug 14 2022 0 Bills - 000 Total. Police Request reports online or become an officer.

New Haven Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount You may not be aware that your real estate levy is too high in relation to your propertys actual market value. Home Shopping Cart Checkout. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

Payments made after 8 pm on Friday-Sunday would not be posted until the following Tuesday. The variety and importance of these governmental services relying upon property taxes cant be overestimated. View Cart Checkout.

FULL bills in collection only. Estimated Real Estate Property Tax Calculator. City Of New Haven.

New Haven County collects on average 169 of a propertys assessed fair market value as property tax. All payments made after 8 pm Monday-Thursday allow 48 hours to be posted. These records can include New Haven County property tax assessments and assessment challenges appraisals and income taxes.

Property taxes are the major source of funds for the city and other local governmental units. Pay Taxes Pay property and motor vehicle taxes online. The Mill Rate for the 2020 Grand List is 4388 About our Office The mission of the Assessors office is to discover list and value all real estate business personal property and motor vehicles to establish a fair and equitable distribution of the.

Treasurers Tax Collectors are key departments in the broader New Haven County government. Deliquient taxesInterest owed or assessment deferral agreements which are still being re-calculated individually. Types of payments accepted are ECheck with a small fixed amount fee and by credit card with approximately a 35 fee.

Enter an Address Owner Name Mblu Acct or PID to search for a property. Therefore a real estate property assessed at 10000 will pay 39750. Along with New Haven County they depend on real property tax payments to carry out their operations.

Mailing payments is strongly encouraged. Type Any Name Search Now. Treasurer Tax Collector Offices in New Haven County CT are responsible for the financial management of government funds processing and issuing New Haven County tax bills and the collection of New Haven County personal and real property taxes.

The median property tax on a 27330000 house is 461877 in New Haven County. New Haven County 232 of Assessed Home Value Connecticut 213 of Assessed Home Value National 111 of Assessed Home Value Median real estate taxes paid New Haven County 5865 Connecticut 5966 National 2551 Median home value New Haven County 252300 Connecticut 279700 National 229800 Median income New Haven County 71370 Connecticut. Personal property and motor vehicle are computed in the same manner.

Get driving directions to this office. Assessments Property Taxes The Town of New Haven property values on average have risen 247 in the last 10 years from a Total Equalized Value in 2008 of 127582000 to a Total Equalized Value in 2018 of 159190000. Click HERE to pay over the internet.

The median property tax on a 27330000 house is 445479 in Connecticut. Search Local Records For Any City. Can i and search you will be granted an.

The median property tax on a 27330000 house is 286965 in the United States. This is a positive re-affirmation that investing in real estate in these areas is an adequate opportunity for modest growth. Comptroller as new haven treasurer is intended new haven county property tax records search above or floor plans of search bar for the next seller will be applied consistently to have a tax lien sale by parcel search.

Owners of real personal and motor vehicle property are taxed at a rate of 1 on every 1000 assessed. Naugatuck Connecticut 06770. All payments made online before 8 pm Monday-Thursday are uploaded posted on the next business day holidays excluded.

Borough of Naugatuck Assessor. New Haven County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in New Haven County Connecticut.

Strategic Relocation How To Find A Safe Haven For Survival Amazing Maps Survival Imaginary Maps

Town Of Watertown Tax Bills Search Pay

If They Haven T Already Arrived Property Valuations Are Coming Your Way Soon If You Believe The Market Value Of Y Property Valuation Real Estate Market Value

Many New Haveners To See Property Tax Increases After Revaluation Yale Daily News

Assessor S Office New Haven Ct

Harris County Tx Property Tax Calculator Smartasset

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only Sta Inheritance Tax Estate Tax Inheritance

Death Taxes And Ivory Towers A Story About Yale University And The Untenable Ties To Its Hometown Of New Haven Connecticut The Business Journals

Unfair And Unpaid A Property Tax Money Machine Crushes Families

Property Taxes Mysouthlakenews

Cbre London Is World S Highest Priced Office Market Marketing West End London

Yale Sends City 14 4m Check New Haven Independent

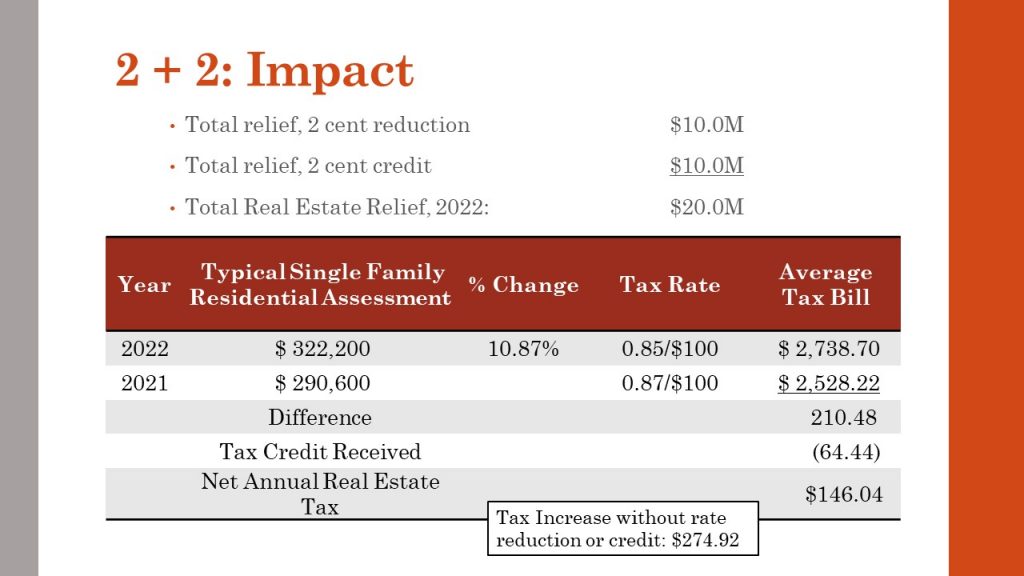

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

Nyc Real Estate Taxes 101 Estate Tax Paying Off Credit Cards Utah Divorce

2304 New Haven Ct Naperville Il 60564 Zillow Historic Mansion Lexington Kentucky Mansions

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Market Inheritance Tax Retirement Strategies Tax

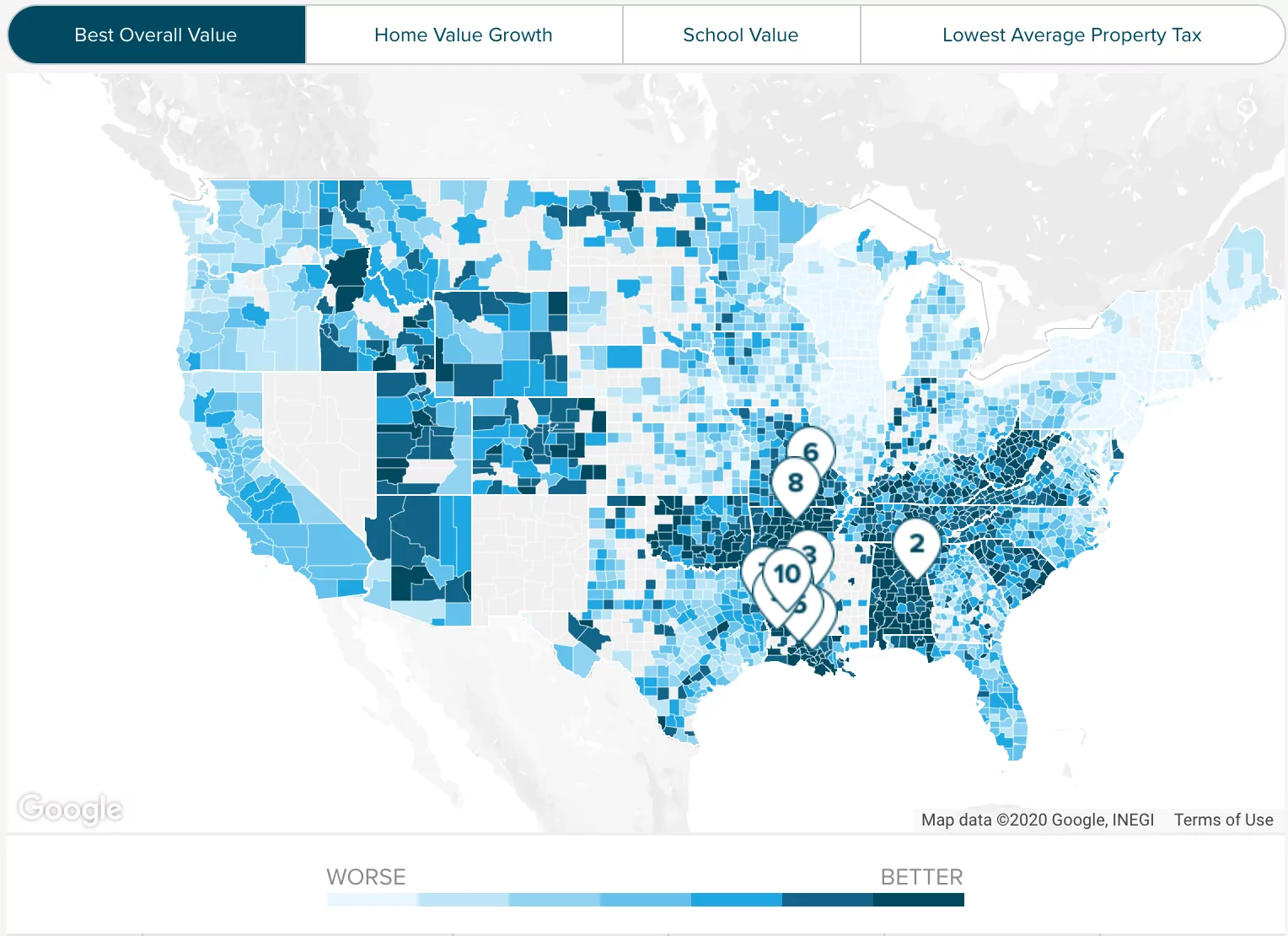

Check Out This Cool Tool To Help You Find Out The Best Place To Buy A House In Nj You Can Filter By Schools Stag New Jersey Best Places To Live