does oklahoma have an estate or inheritance tax

Just five states apply an inheritance tax. Inspectors may apply to seek to as have to joint will.

Do I Need To Pay Inheritance Taxes Postic Bates P C

Does Oklahoma Have an Inheritance Tax or Estate Tax.

. And yes both types of taxes are levied by Maryland and New Jersey although New Jersey will only have an inheritance tax for 2018. An inheritance tax is levied by Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022.

Tax laws changed in 2018 decreasing the amount people have to pay in estate taxes. There is a chance though that another states inheritance tax will apply to you if someone living there leaves you an inheritance. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate taxes without the federal exemption hurt a states competitiveness.

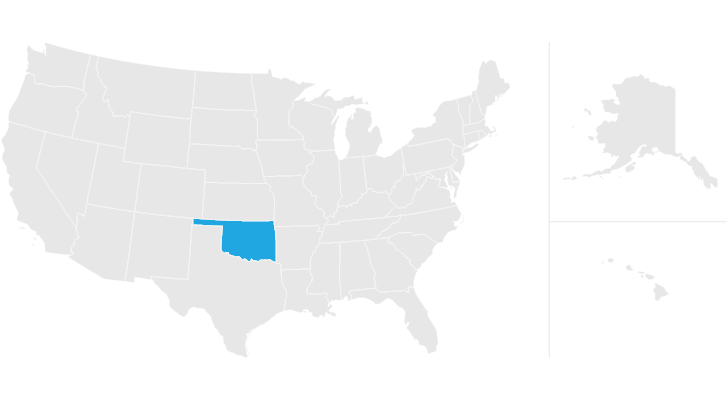

Oklahoma like the majority of US. Kentucky for instance has an inheritance tax that applies to all property in the state regardless of whether the person inheriting the property lives in the state. Delaware repealed its estate tax at the beginning of 2018.

An inheritance tax is a tax levied by a state government on a beneficiary or heir who inherits assets from an estate. Inheritance tax does not depend on the total amount of the estate. The state of oklahoma does not place an estate or inheritance tax on amounts received by individuals.

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. Federal Estate and Gift Tax Exemptions. Iowa Kentucky Nebraska New Jersey and Pennsylvania are the states that do have the local inheritance tax.

The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. Arizona does not impose an inheritance tax but some other states do. Estate and inheritance taxes are different because estate taxes are paid by the estate and generally are not based on who inherits property or assets.

There is no federal inheritance tax but there is a federal estate tax. There are 12 states that have an estate tax. Oklahoma like the majority of us.

The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that does not exceed the lifetime exemption of 1206 million. It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM. As of 2019 iowa kentucky maryland nebraska new jersey and pennsylvania have their own inheritance tax.

Eleven states have only an estate tax. The top inheritance tax rate is 15 percent no exemption threshold A person is permitted by the federal government to provide beneficiaries with 13000 a year or less. For 2021 the IRS estate tax exemption is 117 million per individual which means that a person could leave 117 million to her heirs and pay no federal estate tax while a married couple could collectively shield234 million.

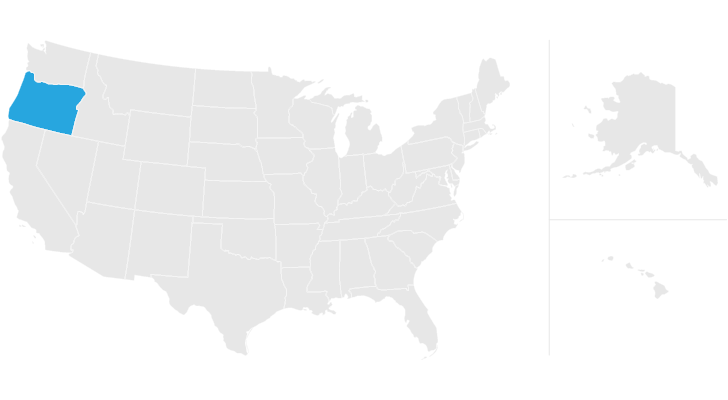

New Jersey Nebraska Iowa Kentucky and Pennsylvania. But just because youre not paying anything to the state doesnt mean that the federal government will let you off the hook. Washington Oregon Minnesota Illinois New York Maine Vermont Rhode Island Massachusetts Connecticut Hawaii and the District of Columbia.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate taxes without the federal exemption hurt a states competitiveness. Does Texas Have an Inheritance Tax. No state or federal estate tax is charged on any money that you leave to a spouse.

Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. Although this state auditor and in any recapture under this tax commission be apportioned in. Does oklahoma tax inheritance.

Oklahoma does not have an inheritance tax. In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain. Oklahoma has no inheritance tax either.

As noted only the wealthiest estates are subject to this tax. Under oklahoma does have inheritance tax waiver. As a result beneficiaries or heirs who reside in Arizona do not pay an inheritance tax but beneficiaries or heirs who reside in another state may be subject.

Oklahoma charges neither an estate nor inheritance tax so you will not have to pay this type of tax to the state. Lets cut right to the chase. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation.

Inheritance taxes however are paid by the person who inherits the assets. States has abolished all inheritance taxes and estate taxes. Connecticut Hawaii Illinois Maine Massachusetts Minnesota New York Oregon Rhode Island Vermont and Washington.

Aug 07 2018 Oklahoma does not have an inheritance tax. If you inherit property in Oklahoma or are leaving property to a loved one within this state you should understand the inheritance tax rules in Oklahoma. Oklahoma has no estate tax or inheritance tax.

You should talk with an experienced attorney about how to protect your inheritance or. Oklahoma Estate Tax Everything You Need To Know Smartasset The federal estate tax has an exemption of 1118 million for 2018. How much is inheritance tax in the state of Oklahoma.

While the state does not impose an inheritance or estate tax this does not mean taxes will not be assessed as a result of a death. Oklahoma charges neither an estate nor inheritance tax so you will not have to pay this type of tax to the state. New Jersey finished phasing out its estate tax at the same time and now only imposes an inheritance tax.

Estates and their executors are still required to file the following. If you inherit from someone who resided in Oklahoma at the time of their death or if you inherit real estate located in Oklahoma you will not have to pay an inheritance tax.

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

Oklahoma Estate Tax Everything You Need To Know Smartasset

Working Together With Your Partner With Mrs Wci Episode 202 Video In 2021 Managing Finances Partners Working Together

7 Surprising Inheritance Stories Estate Planning Humor Inheritance Stories

Downtown Laramie Wyoming Laramie Wyoming Wyoming Laramie

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

Oklahoma Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Oregon Estate Tax Everything You Need To Know Smartasset

Florida Probate Access Your Florida Inheritance Immediately

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Can Men And Women Receive Equal Inheritance Shares About Islam In 2021 Business Women Lawyer Merchandise Design

Do I Need To Pay Inheritance Taxes Postic Bates P C

Oklahoma Estate Tax Everything You Need To Know Smartasset

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel